What is the AGAP Program?

Increase buying power to reach your homeownership goal with the Affordability Gap Assistance Program (AGAP) from Oakland Housing.

This new second mortgage program can help middle income buyers affordably buy a home in select markets.

AGAP is a second mortgage designed to expand buying power up to 25% for middle-income families who are priced out of homeownership due to rising home values.

AGAP fills the “affordability gap” between what a household can reasonably borrow and the actual purchase price of a quality home in today’s market and is offered in low-to-moderate income census tracts and majority diverse census tracts across Oakland and Wayne Counties.

AGAP’s impact is designed to be both individual and systemic. At the household level, AGAP creates a pathway for buyers who are “mortgage ready” but financially stretched by appraisal gaps or rapidly increasing home prices. At a market level, AGAP strategically injects demand into areas where stable, middle class homeownership is critical to sustaining neighborhood income diversity. Overall, AGAP seeks to help reduce the inequitable cost burdens that have historically limited access to homeownership.

Service Area:

- Wayne and Oakland Counties

- Low-to-moderate income census tracts

- Majority diverse census tracts

Property Types:

Single family homes or site condos

- Newly constructed

- Existing homes that have had at least one major system replaced

Eligibility:

- Income 80-120% of Area Median Income

- Minimum FICO score 620

- No ownership of other real estate

- HUD Approved Education Course

- AGAP Education Course

How does AGAP Work?

AGAP works by offering a 30-year second mortgage with flexible interest rates and repayment terms up to $80,000, limited to 25% of the total purchase price.

- For the first five years, AGAP requires zero payments at a 0% interest rate.

- Then, for the next five years, interest-only payments at 2% below the first mortgage interest rate.

- Finally, the remaining 20 years with fully amortized payments at an interest rate matching the first mortgage.

Eligibility

To be eligible for the Affordability Gap Assistance Program, an applicant must meet specific requirements, included but not limited to:

- General borrower eligibility must follow standard lender underwriting protocols and guidelines.

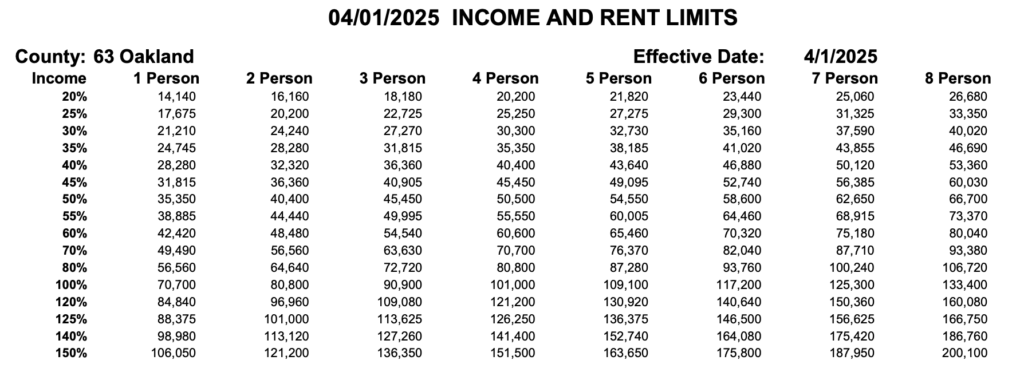

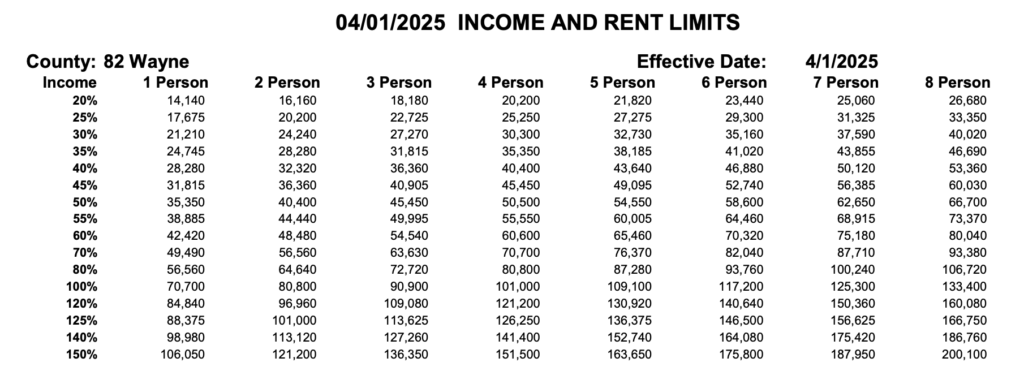

- The threshold for total household income is determined based on the MSHDA issued Area Median Income (AMI) for the subject property’s county and the borrower's household size (outlined here).

- All fully renovated properties require a home inspection and appraisal comparison to confirm the condition of the property.

Please contact us for additional details regarding program eligibility and documentation requirements.

The Affordability Gap Assistance Program (AGAP) is available for individuals or families who meet the following criteria:

- Not currently a homeowner

- Have found a home they wish to buy in either Wayne or Oakland Counties

- Able to apply for a mortgage

- Meet income criteria, outlined here

Would you like to speak to someone about applying for this program? If so, inquire below.